EdTech Public Company Update - Fiscal Year 2022

Starting Coverage

Hello!

This is the first edition of my quarterly public company analysis newsletter. It is the paid sister newsletter to the weekly EdTech Thoughts newsletter.

This newsletter aspires to be the top destination for information about the *strategy* of public EdTech companies, informed by the data these companies provide in their earnings calls, investor presentations, and SEC forms. Please note the word strategy above - while reading the financial statements of the public companies is part of my analysis, I will not be making Buy/Sell/Hold recommendations or sharing DCF models.

Paying for this newsletter will also give you access to the EdTech Funding and M&A Database, an evergreen list of publicly announced financial transactions in the EdTech space. Today, it is a searchable database of 370 global transactions from January 2022 to today. It is updated with new transactions every Sunday.

Lastly, this post should be thought of as a “starting coverage” post. In it, I will say a few words about the FY 2022 earnings season and call attention to key metrics for the 6 public edtech companies - 2U, Coursera, Udemy, Chegg, Duolingo, and Pearson - that I am most familiar with.

Going forward, I plan to refine the format, increase the detail with which I cover these companies, and start coverage of additional companies. As with my weekly newsletter, the goal of this public company update newsletter is to provide a regular (at least quarterly, with deep-dive posts often occurring in between), information-dense 5-10 minutes of reading that deepens your knowledge of the EdTech space over time.

Please feel free to reach out to matt@etch.club with any questions about me, the subscription, or anything else EdTech related. On to the update!

FY 2022 Earnings Overview

Over the course of February and March 2023, 2U, Coursera, Udemy, Duolingo, Chegg, and Pearson reviewed their Q4 and full-year 2022 financial results. Results varied, as should be expected from companies ranging from the newly public Coursera, Udemy, and Duolingo to the almost-200 years-old Pearson. However, two themes emerged across the 6 companies that also reflect a lot of what I am also seeing in the private edtech markets:

1) ChatGPT and Artificial Intelligence (AI) are everywhere: Each earnings call featured at least one substantial AI reference. Discussion of chatGPT specifically took up roughly a quarter of Coursera, Duolingo, and Chegg’s earnings calls.

Duolingo did the best job getting out ahead of questions; They announced a premium ($30/month), OpenAI-enabled product as part of their earnings release. Analysts were harder on Chegg. I believe their concerns are misguided - OpenAI’s business model is selling infrastructure to companies, not building direct-to-consumer businesses.

2U, Udemy, Coursera, and Pearson are all working to incorporate AI into their content portfolios. Udemy already features 100+ chatGPT courses in their course library, but 2U’s $10K Master’s in AI with UT Austin seems like it will be the most significant offering to come out of the AI boom.

2) Layoffs: Every company discussed the implications of a layoff they had conducted over the past 15 months, except Duolingo.

2U’s layoffs were the most substantial, costing $35-40M, but helping bring the company to cashflow positivity. The rest of the layoffs were more targeted, costing the companies $2-10M each. I expect all 6 companies will remain relatively conservative in their hiring as the macro economy remains in flux.

February’s Dear Colleague Letter (DCL) from the US Education Department (ED) and the continued fragility of the banking system will also impact the 2023 performance of these EdTech companies. Unfortunately, the timing of both did not align well with the calls where they mattered most, so we do not have management perspectives or updated financial forecasts that factor them in.

Suffice it to say, each public company’s management team had to make tough strategic decisions in 2022 and those were reflected in the reviews of their fiscal years. However, each team sounded relatively optimistic that the tough decisions were (probably) over and that 2023 would be a year focused on execution.

Charts

As mentioned in the preamble, this newsletter is not about stock-picking. The closest I will get are the charts in this section, which I want to use to provide a visual of the EdTech narrative from pre- to post-COVID.

Company Notes

The goal of this section is to provide a set of operating metrics by which to assess the health of each respective business. Today, these metrics focus on topline revenue and gross margin, whether the core business is providing or using cash, growth rates, and company-provided KPIs. I may adjust these metrics over time.

2U

Notes: 2U walked a financial tightrope over the course of 2022. While the company’s debt remains a burden, early results - including a 34% drop in cost per lead - from the integration of the edX platform have been positive. The company’s new, more flexible revenue share options also sound like they are contributing to a positive sales pipeline for the Degrees business. It is probably too early to tell, but the open question for me (which also applies to Coursera) is whether/how LTV diverges between new and old registered learners.

Intentionally provocative opinion: 2U’s Degrees business will see unexpectedly high growth in 2022. Non-elite universities are finally seeing the upper bound of what they can charge for tuition and starting to make price cuts. I think this trend may accelerate to encourage Fall 2023 enrollments, which should make 2U’s recruiting function easier.

Coursera

Notes: Coursera’s monetization funnel (slide 18 of their investor presentation), with price points from free to $40K+ and everywhere in between, remains one of the best-articulated strategies in EdTech. They are also the only public EdTech company that breaks out registered users by geography, which is critical to contemplating what the LTV of a user might look like. (The company does not break this out, but I suspect that a user in Mexico monetizes at a different rate than a user in the US.)

Of note, total volume of new registered users continues to grow, but the growth rate of new users appears to flattening at around 5M per quarter. There are a variety of possible explanations for this; I’m not sure what the right lesson is yet. Additionally, the company’s largest content partner - Google - incurred an extra $25M of cost in their contract renewal. I’m not sure why this happened or what the charge looks like (I don’t think it is a $25M lump sum directly to Google), but I am surprised that Google forced it through.

Intentionally provocative opinion: Coursera will make the largest EdTech acquisition of 2023. Like Udemy, Coursera is placing significant emphasis on the growth of their Enterprise business. Today, that business is mostly content bundles. It would make strategic sense for the company to buy or build more vertically into HR departments.

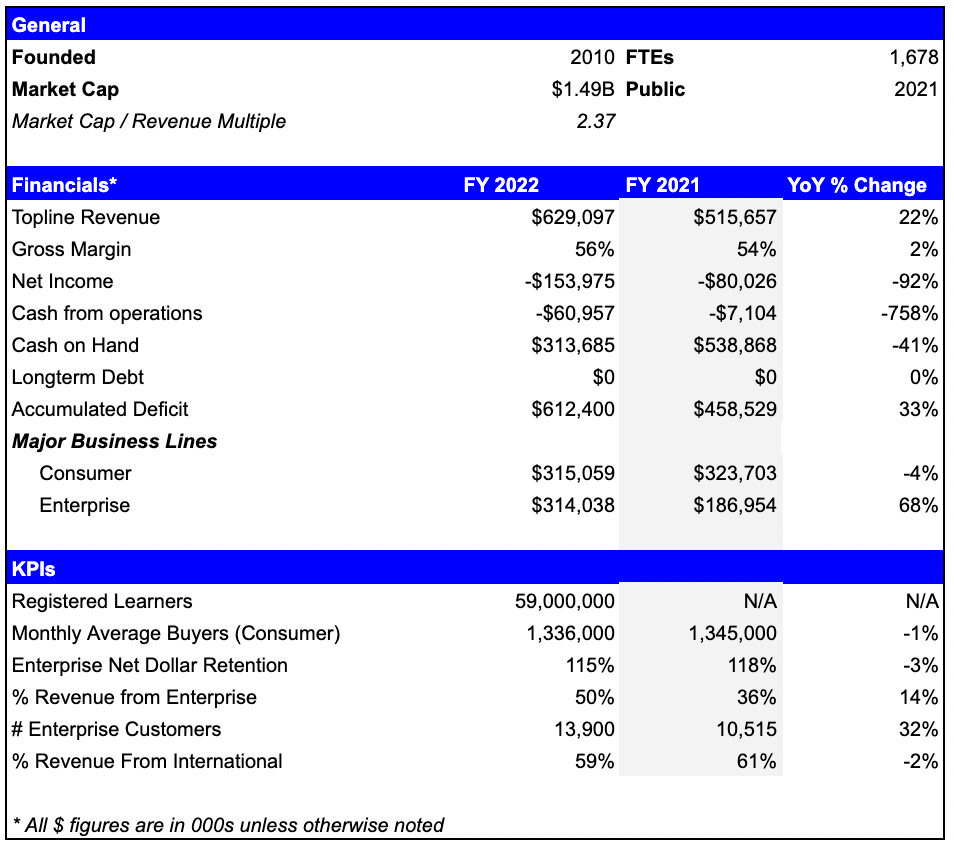

Udemy

Notes: Udemy is in the midst of transitioning CEOs, from Greg Coccari to Greg Brown. It seems to be a planned transition, as Greg Coccari will be retiring.

On the business side, Udemy claims to have offered the first course covering chatGPT (at least among the major players). The company highlights this fact as an example of the strength of their creator-led content development model. Also of note, Udemy offers almost half of their courses (85K of 200K total) in a language other than English. This is consistent with ~60% of Udemy’s revenue coming from outside the US, but surprised me nonetheless.

Intentionally provocative opinion: Udemy’s Enterprise business is the strongest among the public EdTech companies. The company’s impact survey reflects a strong focus on measuring the ROI rather than just providing content, which makes me think it will be relatively resilient in a downturn. I would not be surprised to see announcements of further investment in talent analytics during the course of 2023.

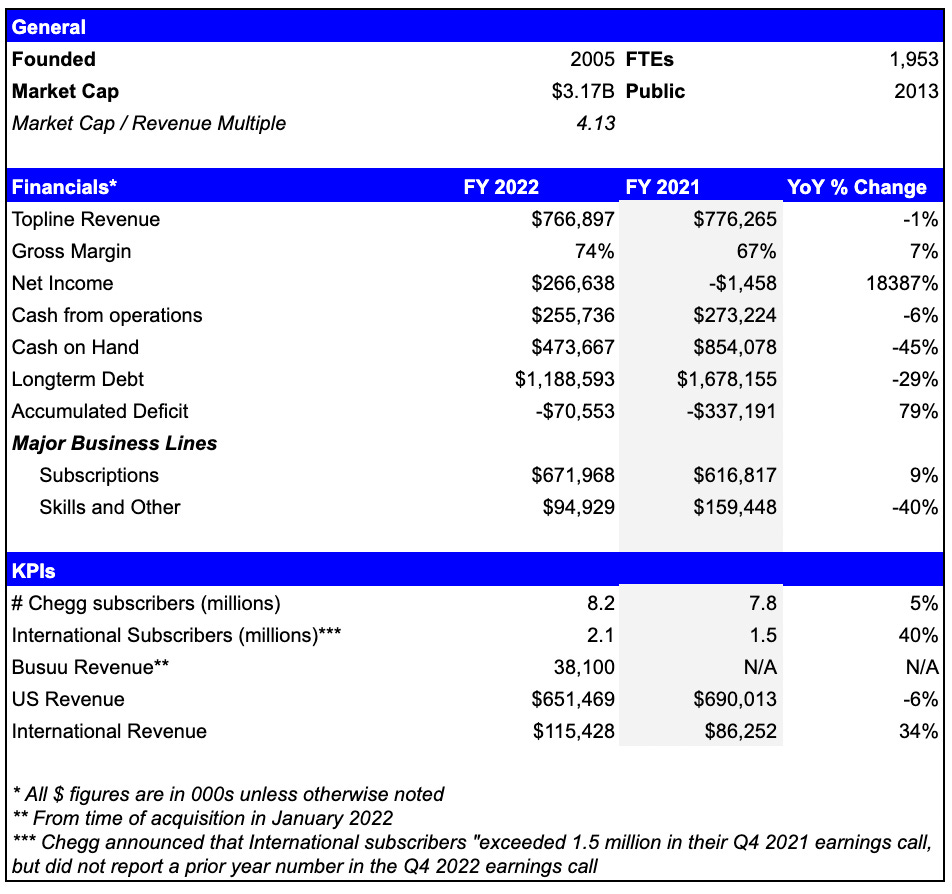

Chegg

Notes: Chegg has had to navigate the largest market cap rollercoaster of any of the EdTech companies. Their core business continues to produce cash, but is not growing as fast as investors would prefer. To rectify this, the company is investing in strategies that build their international presence and expand customer LTV. The most notable of these initiatives are localized apps for Turkey and Spain and the inclusion of non-educational third-party services (like Calm and Doordash) in the company’s flagship subscription bundle.

Given the interest rate environment and the company’s outstanding debt, it seems unlikely that Chegg would propose any major acquisitions. But they do have enough of a cash war chest to be active in the market as private valuations come down.

Intentionally provocative opinion: Chegg will supplement Busuu with another international acquisition this year. The company is counting on international growth to bolster their revenue, but their brand does not have the same value as it does in the US. I think they will look to acquire a company with a stronger brand presence in Europe.

Duolingo

Notes: Duolingo has over 3 million users with an active “streak” (daily engagement on the app) of 1 year or more. That is crazy. The company trusts that optimizing for engagement remains the right long-term financial strategy and it is hard to argue with the results.

What will be interesting is how the company optimizes for the users that they do monetize. Today, that comes from monthly subscriptions or In-app Payments (IAPs) + advertising. IAPs grew 100% year-over-year, but there is probably an upper bound on this growth as IAP payments start competing with subscriptions after a certain point. Similarly, there is a dynamic tension in paid advertising vs. using ad space for paid Duolingo. (The company does not disclose what proportion of ad space is consumed by Duolingo itself.)

Lastly, the company is setting the strategy for a constellation of learning apps - including Math, Reading, Music, and Schools - but Languages is the only vertical monetized today.

Intentionally provocative opinion: The return on Duolingo stock (by price) in FY 2023 will be more than double any other EdTech company. The company is already the fastest-growing EdTech company and seems the least affected by the broader economic downturn (see Layoffs above).

Pearson

Notes: Pearson spent most of 2021 and 2022 re-structuring around a new strategy highlighted by the Pearson+ direct-to-consumer ebook subscription and Workforce Skills go-to-market channel. This shift is sort of symbolically marked by the sale of their Online Program Management (OPM) business, which was announced shortly after earnings. This is a fairly dramatic change for a company whose historic strengths were in the classroom, and I expect some teething pains, but the company appears optimistic that each core business (with the possible exception of Higher Education, where the enrollment cliff could be an issue) will grow over the course of 2023.

Also of note, the company disclosed that it paid ~12X revenue for Credly and Mondly.

Intentionally provocative opinion: Pearson offers the best narrative opportunity in EdTech for an executive to make their name. The company has mostly jettisoned its struggling businesses and now brings more financial horsepower than any other player in the industry to what remains.

If you enjoyed this newsletter, I hope you will share it by forwarding to a friend! If you had this newsletter forwarded to you, I’d love for you to subscribe.

Hey Matt, love reading the newsletter, just subscribed! How do I access the database? Didn't see a link anywhere