Hello!

I’ll be in Austin next week for SXSWedu, please give me a shout if you’ll be around! On to the news.

Funding / M&A

NxtWave raises $33M: Hyderabad-based NxtWave provides professional upskilling courses, predominantly in the technology domain. Raising $33M is a significant jump for the company, which had previously raised $2.8M. The company’s investors are quite bullish on the early-career professionals the company targets, noting that 63% of college graduates in India are unemployed.1

Hirelogic raises $6M: Reston-based Hirelogic records in-person and virtual interviews to provide automated feedback on both interviewers and job candidates. Anecdotally, “Conversational analytics” like what Hirelogic provide feels like a growing domain. Otter AI has paced the startup field (and an increasing number of my Zoom calls), raising over $50M, with Airgram and Supernormal competing for attention. The existential question for all of these companies is how defensible a domain-specific strategy matters relative to the general-purpose features Microsoft is adding and Zoom is likely to add.

Plum raises $6M: Waterloo-based Plum uses psychometric data to help employers make better talent management decisions. See “Story” below for more thoughts!

AdmitKard raises $6M: Noida-based AdmitKard helps students in India and 25 other countries apply for and study at universities outside of their home country. Universities pay for promotion on the platform.

Strive raises $1.3M: Singapore-based Strive provides coding lessons to kids aged 8 to 16. The company plans to use the funding from this round to build out a programmatic curriculum that allows the lessons to be scaled from a 1:1 teacher:student ratio to at least 1:4.

TPG’s Rise fund acquire Asia Pacific University for $300M: Since launching their Rise fund in 2016, TPG has quietly built one of the more diverse EdTech portfolios in private equity, including Renaissance Learning, Everfi, Instride, PresenceLearning, and Meishubao Education. The fund now adds Kuala Lumpur-based Asia Pacific University to the mix.2

Perdoceo acquires Coding Dojo for $53M: Founded in 2013, Bellevue-based Coding Dojo was in the first wave of coding bootcamps. The company had largely avoided the venture fundraising market until last summer, when it raised $10M in venture debt. It is somewhat unexpected that Coding Dojo would exit less than a year after fundraising, but the company may have appreciated the larger infrastructure that publicly traded Perdoceo provides in a bootcamp market that is maturing around a relatively small set of B2B-focused players.

US News acquires collegeadviser.com: Apparently sensing the existential risk associated with elite universities pulling out of the college rankings game, US News is acquiring a direct-to-consumer college advising company whose top pricing tier is “Ivy Plus.” Skepticism about US News’ intent aside, figuring out how to guide the college selection process with schools pulling out of the traditional rankings process is a real problem.

Co-Creation Hub raises $15M for edtech-focused accelerator focused on Nigeria and Kenya: The accelerator plans to bring 72 edtech companies through its program over the next 3 years while also working to raise a more traditional venture fund to provide follow-on funding to the companies that come through its accelerator.

Looking for a job or hiring in EdTech? Check out the ETCH job board.

Story

The Publishers are going to Work

Last year, we discussed Arizona State University’s entry into the MOOC market in the context of Fast and Furious movies. Today, I’d like to discuss the publisher’s moves into the workforce world using the Lord of the Rings as my crutch.

My favorite characters in the Lord of the Rings are the Ents. To summarize, Ents are ancient and naturally immortal. They spend a lot of time thinking but are very careful with their actions. They do not, generally, concern themselves with the “wars of men” because, well, most of the wars don’t matter in the long run.

However, when an Ent gets riled up, it matters.

I think of the publishers similarly. Pearson, Cengage, and Wiley (among others) all have 100+ year histories of doing one thing: selling educational content to students.3 They've experimented with supplementary businesses, but these inevitably got sold off | during bad | times. The core remained relatively untouched.

Until the past few years, when the discussion about whether the publisher’s core market - traditional higher ed - was serving its intended purpose started escalating. A war was finally brewing that merited the full force of the publishers’ attention.

They are doing a variety of things to respond to this threat, including direct-to-consumer | plays. But the trend that sticks out to me is the $500M+ Pearson, Cengage, and Wiley cumulatively spent in the workforce market acquiring Credly, Infosec, mthree, Faethm, PRDI, and Mondly.

Cengage and Wiley are also telegraphing their workforce intentions in the press too. Cengage has no fewer | than | 4 press | releases related to their workforce initiatives in the past 6 months, which Wiley has | almost | perfectly | mirrored. Pearson has fewer examples of workforce announcements, but has invested in at least 5 workforce companies over the past few years - Plum (same link as above), Springboard, Knowledge to Practice, Talespin, and Velocity Career Labs.4

We’ve seen quite a bit of venture investing in the workforce space over the past ~5 years, but the publishers are the financial heart of the education industry. They validate markets in a way that no other industry players currently do and provide a substantial portion of the strategic exit options a startup might have. All of the above examples read to me like bets on a future of higher education that is substantially more skill-based and employer-focused than it is today.

Asks

Jenn is looking for folks interested in joining a virtual conversation on "The Relevance of HBCUs to American Life and Education” on March 8 at 4pm ET

If you would like an Ask featured in a future EdTech Thoughts post, please fill out this form.

Links

How to make the most of ESSER funds

I spend a lot of time thinking about incentives. What are the core principles that will decide if this business model or policy action will work? Inadvertently, this article does a great job showing how the use-it-or-lose-it nature of ESSER funding incentivizes K12 schools to make inexplicable long-term investments - such as investing in private cell phone towers - rather than tactical improvements to win students back to public school classrooms.5

GSV’s Michael Moe: “India is the most important market for us”

It is early in the year and funding announcements tend to lag the market by 3-6 months, but the recent quantity of investments in India suggest Moe is not the only edtech investor leaning into an India thesis. Of the 63 institution-led funding rounds I’ve tracked this year, India leads the way with 18 announcements. The US is second with 14.6

Inside Higher Ed (IHE) covers the proliferation of BORGs on college campuses. Is a BORG a robot? An accidentally sentient AI? Aliens?

No, dear reader. A BORG is a BlackOut Rage Gallon.

I give IHE credit for writing a straight-faced article about the serious issue of binge drinking on college campuses, but the TikTok recipe in the second paragraph did make me laugh. (Parents of teenagers, do not click that link.) The key quote, in case someone in your life (probably under the age of 22) suggests that BORGs are actually a harm reduction tool, “If someone is having 16 drinks in one sitting, even if it’s mixed with water, that still counts as high-intensity or extreme drinking.”

Question of the Week

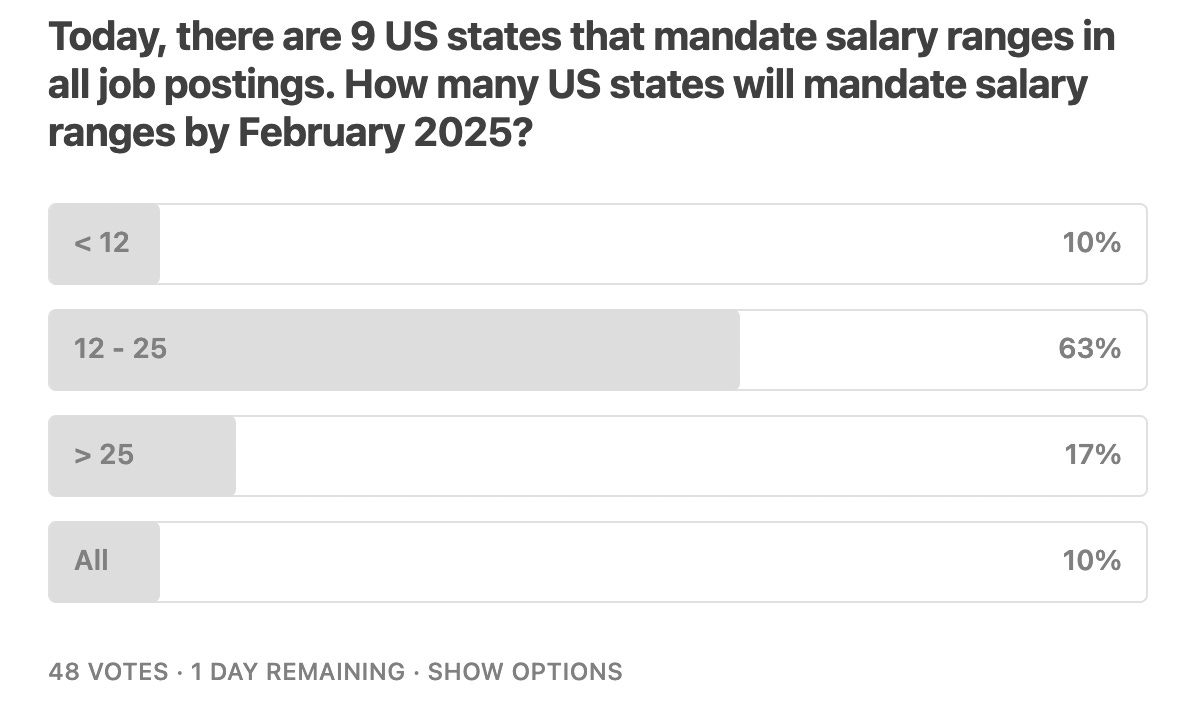

Note: votes are anonymous. Shoutout Atin for coming up with this question

Results of last week’s poll:

Ed Tech Thoughts is a short ( ~ 5 mins), weekly overview of the top stories in EdTech, with a few (hopefully interesting) gut reactions attached. If you enjoyed this edition, I hope you will subscribe and/or forward to your friends!

If I missed something, or there is a topic you’d like to learn more about, I encourage you to submit a story! Submissions can be named or anonymous

Disclosure

This is the first time I have seen a stat like this for the Indian college graduate market and came via quote from the VC Partner who led this funding round. I would love to see a more official source!

Bloomberg notes that one of TPG’s funds acquired International Medical University, also located in Kuala Lumpur, last year. However, it is not clear whether this was the Rise fund or a different branch of the firm; International Medical University is not listed as part of the Rise fund’s portfolio.

So well, in fact, it seems to have been carved out of last week’s Dear Colleague letter!

Please note that Pearson contributed portions of these funding rounds, not the whole thing. The number is still in the millions, but do not add the numbers in these announcements to approximate how much.

There are plenty of long-term investments that would be reasonable uses of ESSER funding, but you will never convince me that any traditional K12 public school should maintain its own cell network. The point is that coming up with big-ticket items to spend on is maybe not where schools or districts should be focused.

Please note: # announcements does not equal # of dollars! US companies have raised $375M to India’s $130M so far this year. If you are interested in seeing the dataset I pulled this from, access to it is one of the perks of subscribing to ETCH Public Company Updates. More details to come!