EdTech Thoughts 4/10 - 4/16

Smells like Teams Spirit

Hello!

It is a big week in the EdTech world with the annual ASU GSV conference, I’d love to say hello if you’ll be in attendance.

On to the news!

Funding / M&A

LMS365 raises $20M: Århus-based LMS365 provides an LMS inside of Microsoft’s Teams application. A relevant business fact about this deal: it was led by Blue Cloud Ventures, whose growing EdTech portfolio also includes ApplyBoard and Go1 (who appear to be a channel partner for LMS365). A fun party fact about this company: it is run by Ole & Steen, who, for those who do not follow the high-end international pastry scene, are the folks who built and sold Lagkagehuset for 1,000,000,000 Kroner in 2017.1

MindX raises $15M: Hanoi-based MindX offers a sort of afterschool program-bootcamp hybrid. The company’s target demographic is teenagers who would otherwise be participating in traditional STEM afterschool programs, but MindX’s curriculum is more similar to that which a technical bootcamp might offer. Also similar to a bootcamp, the company’s focus is placing students with hiring partners upon program completion. The funding from this round will be used to double down on the company’s strength in the Vietnam market, building new content offerings and technical tools to serve their current demographic.

Spotted Zebra raises $1.8M: London-based Spotted Zebra helps employers assess the skills of both job applicants and their current labor force.

Oneistox raises $1.2M: Delhi-based Oneistox makes upskilling courses for the architecture, engineering, and construction (AEC) industry. Following Pluralsight’s success hyper-focusing on content (and now assessments) for technology organizations, I’ve been curious to see if/when more vertically-oriented content companies would emerge. AEC is as good a field as any to try it in, with a substantial number of workers and a relatively specialized set of content.

PeopleGrove acquires Student Opportunity Center: Arlington-based Student Opportunity Center helps colleges and universities embed work experiences into their curriculum. The company joins San Francisco-based PeopleGrove, which helps colleges and universities connect students and alumni for mentorship experiences. This acquisition comes 11 months after PeopleGrove was bought out by private equity firm The Riverside Company, but it is not clear whether this move was opportunistic or a sign of a more programmatic M&A strategy.

Times Higher Education (THE) acquires Poets & Quants: Oakland-based Poets&Quants is a sort of one-stop-shop for business school information. By their own accounting, the site is visited by “more than 85% of the active MBA applicant market for the world’s top 100 business schools, on a monthly basis.” Poets & Quants is the 4th education | media | entity to be gobbled up by London-based THE since Inflexion Private Equity Partners’ 2019 buyout of the company.

Reach Capital raises $215M Fund IV: As mentioned by Techcrunch, San Francisco-based Reach Capital was one of the first venture capital funds to focus exclusively on the EdTech sector. Raising a fund amidst last year’s broader market downturn suggests that the Reach team’s focus on the sector has worked out well.

Looking for a full list of companies that have raised venture funding this year? Upgrade to paid for access to the EdTech Funding and M&A database

Story

Vertical and Horizontal Integration

Just in time for GSV, this week both Coursera and Guild made substantial product announcements. Coursera announced an expansion of their product suite to include placement services and Guild (no longer Guild Education) announced their move into content. While they require fairly different execution, the rationale for the moves is actually pretty similar.

There are, nominally, 3 ways to grow a business:

Increase the number of customers you have

Increase your prices (or, if you charge per employee, the number of employees using your product)

Sell new products to the customers you already have

In the venture world, we tend to focus on #1, but there are defensible reasons to pursue any of these 3 strategies, and none are inherently better than the others. I’m sure Coursera and Guild will continue spending on new customer acquisition, but these announcements - which, again, come at a very strategic time of the year - are clear examples of #3.

There are many potential reasons for spending more resources on #3. My educated guess is that customer acquisition costs rose with the market downturn last year, making the cost of building a new product line more relatively competitive to expanding their sales forces. It may also help the companies advocate for increased addressable market sizes from their investors.

Asks

Rize Education is looking for Sales, Account Management, and Revenue Operations candidates. Email Charlie at canastasi@rize.education if you have any ideas or want to learn more!

If you have an Ask for a future EdTech Thoughts post, please fill out this form.

Links

Most clicked link from last week: BlackRock slashes edtech giant Byju's valuation by about 50% to $11.5 bn

The TPS reports are no longer due on Monday

The US Department of Education (ED) published a blog post with some clarifications to February’s Dear Colleague Letter (DCL). The clarifications are helpful and make clear that ED intended the DCL to be more limited in scope than many - including me - interpreted it to be. That is a good thing and I appreciate that ED (mostly) owned the confusion the DCL caused.

Still, a blog post update to a Dear Colleague Letter leaves something to be desired in the realm of Ed regulation. The continued ambiguity of what rules will actually be enforced makes it sort of irrational to invest in higher ed when there are perfectly reasonable workforce companies to pick from.

For those looking for more details, Phil Hill remains the best place to go for the nuances of what is happening here.

What is the correct amount of revenue to share?

There are a lot of numbers thrown around in the ongoing debate about revenue sharing between universities and third-party vendors. The most famous number is the 60% of USC’s online degree revenues shared with 2U in exchange for 2U’s operation of the program. In this article, the number in question is the 80% of revenues that 2U receives for the operation of UC Berkeley’s bootcamp program.

What’s frustrating to me is these numbers mean nothing without context. It is easy to react to 60% or 80%, but what is an appropriate amount of revenue to share with a partner? Having literally built financial models for bootcamps myself, I feel reasonably confident that Berkeley is getting a decent deal here. I also think it is unlikely that Berkeley would offer a bootcamp without support from a private vendor.

When February’s DCL came out, I was clear in my support for more information-sharing to inform the regulation of third-party vendors. My hope is that a more extensive shared information base brings nuance to a conversation that lacks it today.

Calbright, California’s first online-only community college, took a lot of flak for the way it was launched. Some of it was earned, and some of it was not. I have maintained that the thesis behind Calbright - starting fresh, using competency-based education, and using employer demand to drive program choices - is sound. In fact, it is something our community should be promoting heavily.

Calbright is not out of the woods yet, but the school is growing 8% per month and now serves 2300 students - more than 4 of California’s traditional community colleges.

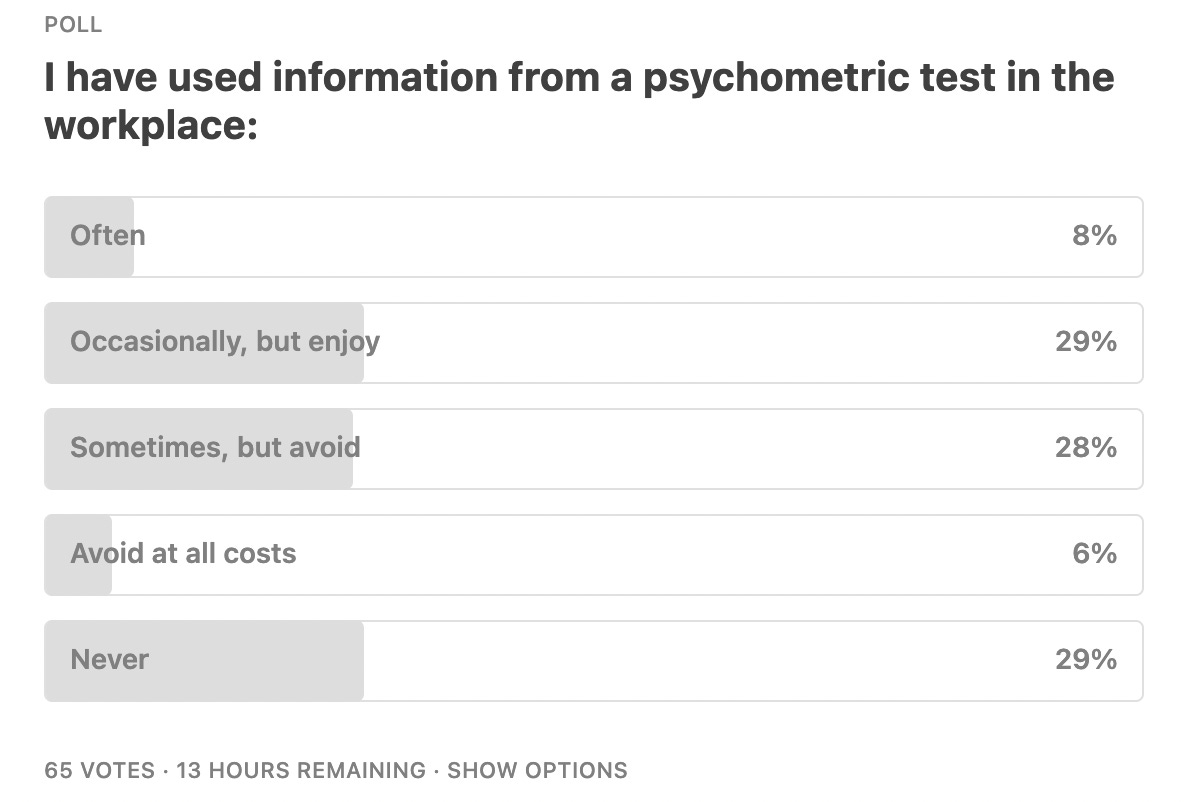

Question of the Week

Note: Votes are anonymous

Results of last week’s poll:

Ed Tech Thoughts is a short ( ~ 5 mins), weekly overview of the top stories in EdTech, with a few (hopefully interesting) gut reactions attached. If you enjoyed this edition, I hope you will subscribe and/or forward to your friends!

If I missed something, or there is a topic you’d like to learn more about, I encourage you to submit a story! Submissions can be named or anonymous

Disclosure

Cue Austin Powers’ Mini Me GIF

Hi Matthew, heard about your newsletter at the Tin Roof party last night. Thanks for writing up the Poets&Quants transaction - we (Tuck Advisors) represented them on their sale to Times Higher Education. I look forward to meeting you at ASU + GSV next year!