EdTech Thoughts Weekly Update 6/6

Those who can, do. Those who can't, meme.

Hello!

I hope that many of you enjoyed Sunday’s edition of Weekend Reading - I apologize for the broken link to the article on Bitwise’s troubles. You can find a working link here. What’s more, today’s note includes my thoughts on what may have led to the 900-person furlough and our role as a community to try and prevent such disasters.

Additionally, this newsletter covers analysis of seed rounds for a personalized learning moonshot and making memes in the classroom + how AI might affect supply and demand of software engineering talent.

As a reminder, this Weekly Update is for paid subscribers only - see below for how to upgrade.

With that, on to the news!

Funding / M&A

Swing Education raises $38M: San Francisco-based Swing Education connects K12 schools with substitute teachers, helping the 45% of US schools that have a staffing problem fill open classrooms. The round is framed as a traditional Series C funding round, but co-led by PE buyout firm Apax Partners, which makes me curious about the terms. Regardless, the company plans to use their new funding to support go-to-market expansion beyond the 7 states they serve today.

Sana raises $28M: Stockholm-based Sana offers an enterprise-focused learning management system (LMS) and knowledge management system. The company believes that injecting AI into this combination of platforms is particularly powerful, helping managers and employees stay on top of everything that is happening across their workplace. The company’s revenue has grown 3X in the past 12 months on the back of features like real-time transcription of company meetings and the ability to write SQL queries of company data.

Maximal Learning raises $5.7M: Seattle-based Maximal Learning is taking on the most challenging problem in education - personalized learning. Not only that, the company endeavors to provide an age-appropriate, personalized educational experience to learners from kindergarten to college. While the scope of this vision is enormous, the founders of Maximal Learning come to it with substantial experience. After selling a previous EdTech startup to Microsoft, each had a 20+ year career leading teams in Microsoft’s Excel and Education divisions.

Antimatter raises $2M: New York-based Antimatter helps students and teachers make memes for the classroom. In the words of founder Jonathan Libov, “To be able to shitpost, you have to understand the subject matter really well.” I couldn’t agree more with that statement and think the company has the potential to break into the market similar to the way Kahoot! brought fun into the classroom (and board room). It will be interesting to see if the pre-revenue company can find a B2C vs. B2B monetization sweet spot in the same way Kahoot! did.

Data Masters raises $700K: Bari, Italy-based Data Masters is the first Italian bootcamp to focus on data science, artificial intelligence, and machine learning. The company will use this round to support their expansion to other countries in Europe.

Learneo acquires Barnes & Nobles’ Digital Student Solutions (DSS): Redwood City-based Learneo is the rapidly-growing corporate owner of Course Hero, CliffsNotes, Quillbot, LitCharts, Scribbr, Symbolab, and LanguageTool. Learneo appears to have gotten a pretty good deal on DSS, buying for ~.5X revenue and < 4X EBITDA, but it is not immediately apparent whether DSS under Learneo will have access to the same acquisition channels as DSS did under Barnes & Noble.1

If you are a Founding Member, you can catch up on the past 2 years of fundraising by visiting the EdTech Funding and M&A database

Story

Bitwise furloughs entire staff of 900

Writing publicly about bad stuff is the hardest part of running this newsletter. Startups are a weird, messy, complex combination of real user demand and hope. There are times when hope outweighs real user demand, even at relatively mature companies. The question I wrestle with daily is at what point am I obligated to call BS on a company’s prospects?

I last wrote about Bitwise in March, after the company raised $80M:

Fresno-based Bitwise is a fast-growing software development agency that uses an apprenticeship model to build its talent roster. The company also focuses on building their teams outside of traditional software development hubs like San Francisco, New York, and Boston. The funding from this round will be used to double down on this strategy, building out physical locations in 40 cities across the US.

I wish I had questioned the company’s foray into real estate more seriously. A software engineer and an intellectual property lawyer raising venture capital to add a tertiary-city commercial real estate rehabilitation division on top of their nascent apprenticeship business is just not a good idea. I thought this at the time and chickened out of writing it. I figured that Bitwise’s investors - including the Kapor Center, Goldman Sachs, and Citibank - must have known something I didn’t.

And still, maybe they did! We do not know what Bitwise’s fatal flaws were yet, but I expect that more details will emerge as the board digs in and lawsuits are filed.

One thing is obvious: when a company furloughs their entire staff without warning, it means something went terribly wrong. In my mind, the most likely scenario is gross financial negligence (perhaps related to their real estate ambitions). The second option is fraud.

If the problem here turns out to be fraud, there will be no proof that the business concept was, in fact, a bad idea. For me personally, there will be no proof of whether I should have taken a more skeptical stance about Bitwise in March.

That is what makes writing, particularly with an audience, so hard. I believe in EdTech and have no desire to be the “bad cop.” I also recognize that there is a point at which giving a company the benefit of the doubt could be harmful. Maybe that point is when they go from 900 to 0 employees or start making jokes about wearing orange jumpsuits, but, more likely, it is earlier, and therefore harder to identify.

There are, of course, no easy answers to these questions. Nor are they particularly novel. But that doesn’t make them any easier for me to navigate, and Bitwise’s troubles felt like a good opportunity for me to reflect on that here.

The Weekly Update is a short ( ~ 5 mins), weekly overview of the top stories in EdTech, with a few (hopefully interesting) gut reactions attached. If you enjoyed this edition, I hope you will subscribe and/or forward to your friends!

Links

Most clicked link from Weekend Reading: Bitwise furloughs entire staff (same link as above)

It makes me a little sad that the most clicked links from the past two weeks have been about layoffs (Guild’s layoff was last week’s most-clicked), though I get why they have a sort of gravitational pull.

How AI will change the labor market

Bryan Caplan’s headline is about how AI changes Higher Ed, but, to me, this article has far more to do with changes in the labor market. One section of the post that I will be coming back to repeatedly (bold mine):

As an economist, I scoff at the idea that AI will permanently disemploy the population. Human wants are unlimited, and human skills are flexible. Agriculture was humanity’s dominant industry for millennia; yet when technology virtually wiped out agricultural jobs, we still found plenty of new work to do instead. I do not, however, scoff at the idea that AI could drastically reduce employment in CS over the next two decades. Humans will specialize in whatever AI does worst.

Demand for Computer Science tests capacity of US universities to deliver

An inadvertent, but sort of funny coincidence that this article follows one about how the need for software engineers will decline over time. What I will point out is that while we have mostly transitioned from an agricultural society to a knowledge economy, there are still over 3 million farm workers in the US. I’m not sure what the “right” number of software engineers is - today there are 1.5 million in the US - but it seems like we are in the wrong portion of the innovation curve to be letting supply dictate that number rather than demand.

Question of the Week

Note: votes are anonymous

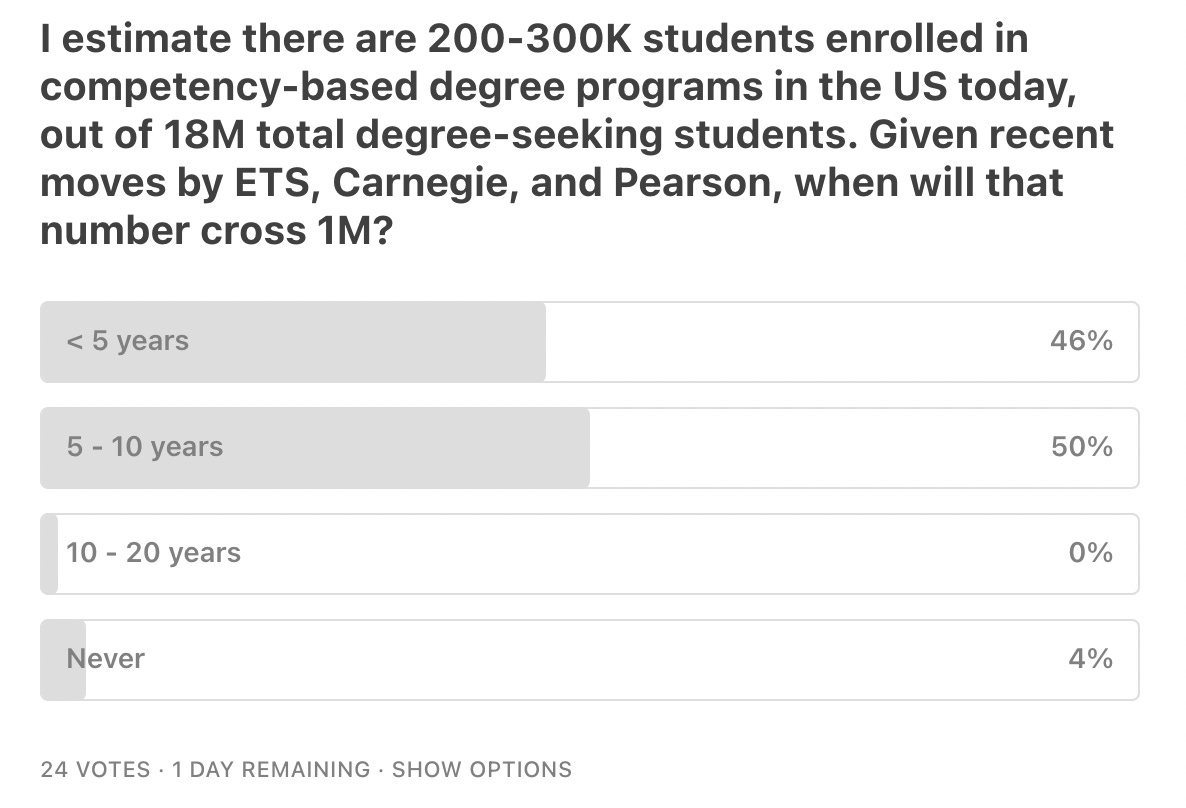

Results of last week’s poll: I am in the 5-10 year camp.

I based these numbers on Barnes & Nobles’ press release and latest financial statements - B&N reported that net proceeds from the deal were $20M, meaning the price was likely a bit higher than that. B&N’s latest reporting had annual DSS revenues in the $35-40M range and annual EBITDA around $5.5M